Bitcoin is struggling to reclaim higher levels as selling pressure intensifies and fear continues to dominate market sentiment. After weeks of volatile price action, the market’s recovery attempts are being met with heavy resistance, with BTC still trading below key psychological levels.

According to data from Lookonchain, the well-known trader known as the BitcoinOG (1011short) — famous for shorting the market during the October 10 crash — is once again making headlines. On-chain data shows that the whale has started dumping BTC, triggering renewed anxiety among traders and investors.

This move has reignited debate across the community, as many analysts consider this trader part of the so-called “smart money” cohort — entities known for anticipating market shifts with high precision. While some interpret the whale’s activity as a sign of further downside ahead, others argue that such events often mark capitulation points where the market absorbs final waves of selling before rebounding.

With uncertainty rising and liquidity thin, Bitcoin’s next moves will be crucial in determining short-term sentiment. The coming days could decide whether this whale’s actions confirm another leg down — or signal the last shakeout before a broader recovery phase.

Whale Activity Intensifies: The BitcoinOG Moves Millions Across Exchanges

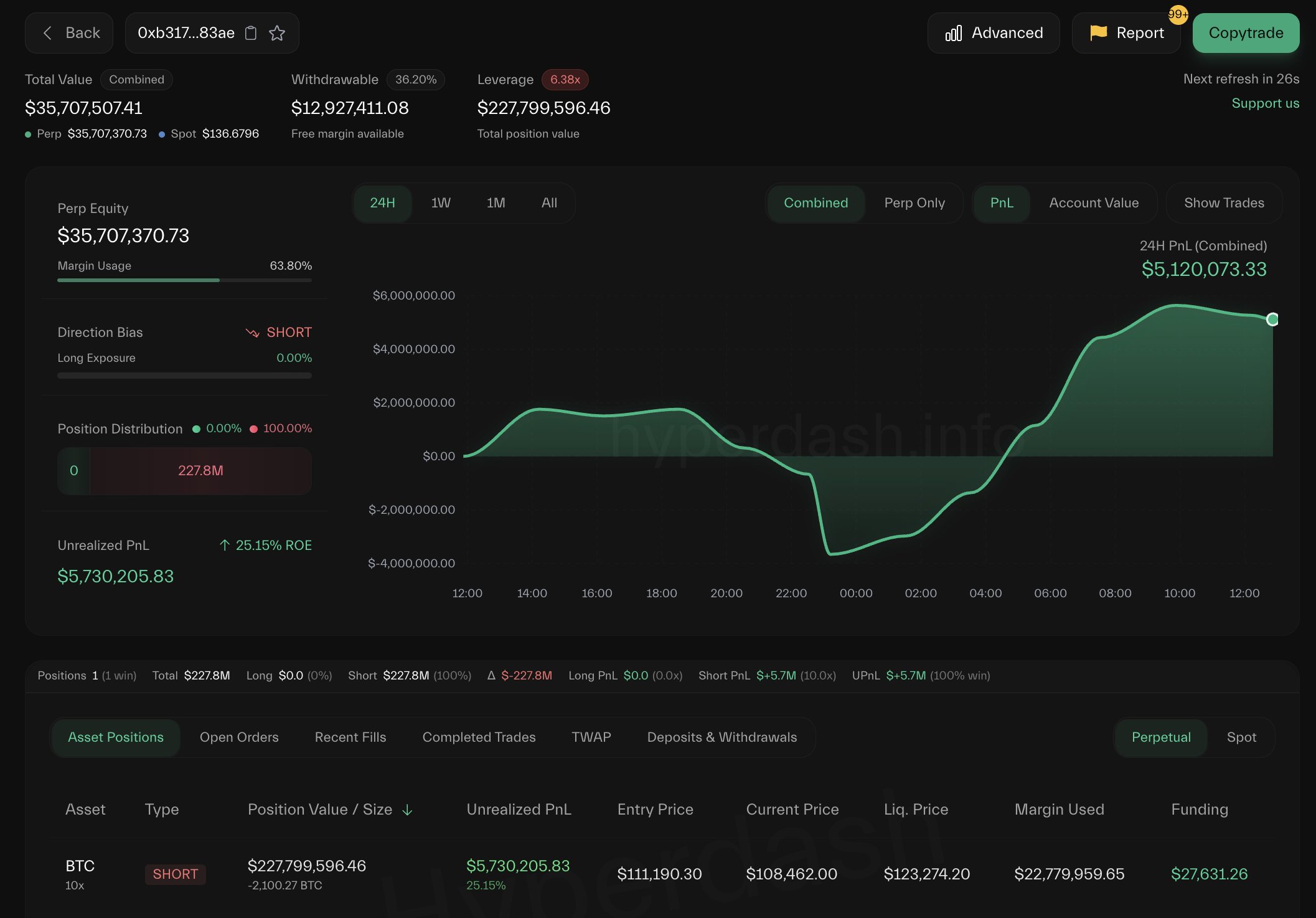

According to Lookonchain insights, the BitcoinOG (1011short) — the trader who famously shorted the market during the October 10 crash — is once again making major moves. Since the market downturn, this whale has deposited 5,252 BTC, worth approximately $587.88 million, into major exchanges including Binance, Coinbase, and Hyperliquid. At the same time, data shows his short position on Hyperliquid has grown to 2,100 BTC, valued at around $227.8 million.

This scale of activity has drawn intense attention from analysts, given the trader’s historical accuracy in predicting market tops. Depositing Bitcoin to exchanges often signals potential selling or hedging behavior, adding to the bearish tone currently dominating sentiment. Combined with the expansion of his short exposure, it suggests the whale could be positioning for further downside or protecting gains from earlier market moves.

However, several experts have urged caution in overinterpreting these transactions. On-chain visibility only provides a partial view — these may be just a fraction of the whale’s total holdings or broader strategy. It’s possible that some positions remain hidden across other derivatives platforms, wallets, or over-the-counter deals.

This uncertainty makes the whale’s behavior both intriguing and concerning. While retail traders often react strongly to such visible movements, seasoned analysts emphasize the need for broader context — including derivatives data, funding rates, and liquidity shifts.

Weekly Chart: Support Retest as Market Faces Key Inflection Point

The weekly Bitcoin chart shows the market struggling to hold above the $108,000 region, a critical short-term support level that aligns closely with the 50-week moving average (blue line). After the sharp drop following the October 10 crash, BTC attempted a rebound but failed to sustain momentum above $114,000, signaling persistent selling pressure near the $117,500 resistance — a level that has acted as both support and resistance multiple times over the past year.

The structure now suggests Bitcoin is in a consolidation phase within a broader bullish trend, but downside risks remain elevated. If the 50-week moving average fails to hold, the next potential support lies near $100,000, which aligns with the lower range of historical demand and the March 2025 breakout zone. A break below this region could accelerate selling momentum and confirm a deeper retracement.

Conversely, reclaiming $117,500 would signal renewed strength, opening the door for a potential retest of the $125,000–$130,000 range. Overall, Bitcoin’s weekly structure remains cautiously bullish, but sustained weakness around current levels would put the broader uptrend at risk — making the coming weeks decisive for long-term direction.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Be the first to comment